March 2017

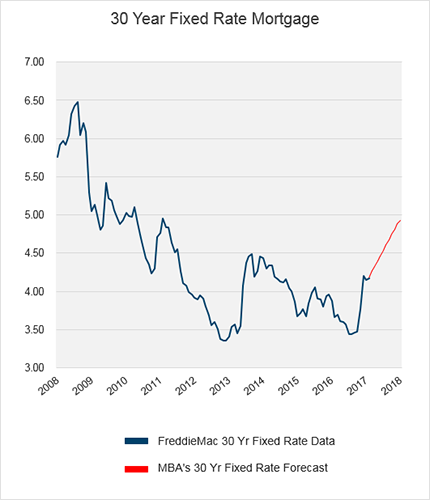

This week, the Federal Reserve announced that they will raise the benchmark rate another quarter point. While this comes as little surprise, it is another confirmation that the era of historically low interest rates is coming to end.

As for the mortgage industry specifically, the MBA’s March forecast adjusted 2017 volume up slightly to 1.6 trillion for the year. This represents a 29 billion increase in volume (12 billion for purchase and 17 billion for refinance) over their February forecast. Even so, the forecast for 2017 is a decrease in volume of 15% over 2016, which totaled nearly 1.9 trillion in mortgage volume. A decrease of 15% likely means most mortgage lenders will see another increase in costs per loan during 2017. The good news is that purchase volume is forecasted to increase 12% in 2017, which could off-set decreases in refinances for many of the industries independent mortgage lenders who traditionally are more focused on purchase business and are more nimble when it comes to changing gears between refinance and purchase business.

Check out our dashboard on the MBA’s March Mortgage Finance Forecast here: https://richeymay.com/industries/mortgage-banking/data-analytics-and-benchmarking/