November 2016

Watching the elections results, it seemed as though the markets might relive the effects of Brexit and extend the life of “historically low” mortgage rates. However, markets quickly rebounded and with the Federal Reserve’s recent economic outlook on November 17th, it looks like rates will actually see steady and modest increases in the coming months. Fed Chair Janet Yellen stated it could be “appropriate relatively soon” for a rate hike. As nonspecific as usual! With this news, it appears that the MBA has slightly increased their rate forecast for the 1st quarter of 2017, up from 3.9% to 4.0%.

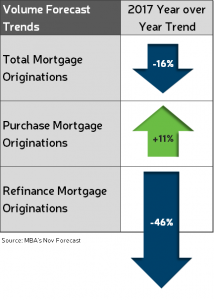

For those lenders working on 2017 budgets, the industry’s mortgage volume is expected to be down by 16% over 2016 levels, which is a decrease of about $300 billion. Refinance volume is forecasted to decrease significantly from $901 billion in 2016 to $484 billion in 2017, while at the same time purchase volume is forecasted to increase by $110 billion.

Check out our dashboard on the MBA’s November Mortgage Finance Forecast here:

https://richeymay.com/industries/mortgage-banking/data-analytics-and-benchmarking/

See Fed Chair Janet Yellen’s entire economic outlook testimony here:

https://www.federalreserve.gov/newsevents/testimony/yellen20161117a.htm