August 2018

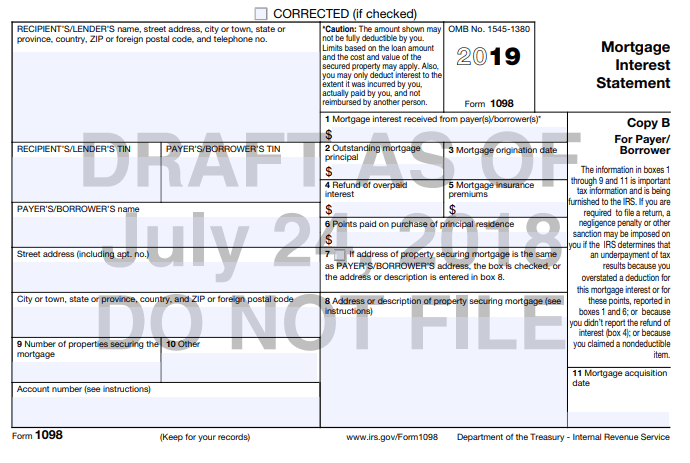

The IRS has released a 2019 draft Form 1098 for mortgage interest reporting.

The description for box 2 will change from Outstanding Mortgage Principal as of Jan. 1, to Outstanding Mortgage Principal. This will relieve confusion and tedious efforts in two situations: 1) When a lender acquires a mortgage subsequent to Jan. 1, the box 2 amount will reflect the balance as of the date of acquisition as opposed to tracking down the Jan. 1 principle amount from a previous lender in the chain of mortgage ownership; and 2) When a lender originates a loan in 2019 subsequent to Jan. 1, the reported principle will be as of the origination date as opposed to leaving box 2 empty.

In addition, box 11 has been added to the draft Form 1098 to report Mortgage acquisition date and will only apply if the 1098 filer acquired the mortgage.

We’ve noted in previous information that the Tax Cuts and Jobs Act of 2017 does not require that any additional information be provided to a borrower to whom a 1098 is issued. Both the 2018 Form 1098 and 2019 draft support this observation and we believe it will continue to be the borrower’s responsibility to determine deductibility of mortgage interest.

As always, the IRS allows submission of comments about draft or final forms, instructions, or publications at IRS.gov/FormsComments. Below is an image of the 2019 draft form 1098 Copy B.

The 2019 draft Form 1098 can be found on the IRS website: https://www.irs.gov/pub/irs-dft/f1098–dft.pdf.

For any questions regarding this information, please reach out to your Richey May tax professional or contact us.